Have you been struggling to get approved for a car loan because of your past credit history? If so, you are in need of a second chance car loan. We call it that, because like the old saying goes, everyone deserves a second chance.

We hope to answers some questions you have about getting approved, even if you have bad credit. So far we have helped thousands of Canadians in all types of situations, which include bad credit, no credit, second chance loans, and of course, good credit.

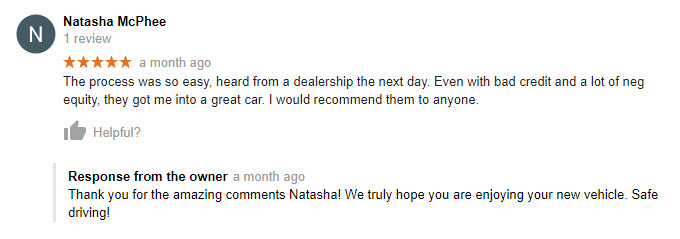

Take it from one of our customers, Natasha. We were able to help her get into a new vehicle almost immediately when she needed a second chance.

Link to review: https://goo.gl/maps/uMWHJpUCDSD2

What exactly is a second chance car loan?

A second chance car loan is also known as a bad credit car loan or non-prime loan. Typically, they are for people who have had trouble getting approved for vehicle financing because of their past credit history. If you suffer from bad credit, then you know that your options can be limited, and finding a bank or dealership who will approve you can be challenging. Almost 1/4 of Canadians fall into the non-prime bucket of auto financing.

The ability to get approved for a car, even if you have bad credit, is crucial for many Canadians, so to have these second chance options is very important.

How can Cheap Cars Canada give you a second chance?

It’s rather simple. We are partnered with dealerships across the country that specialize in approving people with unique circumstances. So if you need a second chance because of a poor credit history, we can help align you with a dealer that will gladly help.

The best part is, our service is entirely free and there are no obligations. If you are not comfortable with the terms, there is no need to commit!

Why is it beneficial to get a second chance loan?

There are many possible answers and reasons as to why a second chance car loan can help. Aside from having the freedom to travel to get to work, school, or go on vacation, it will help start the credit restoration process. After making consecutive payments for 12 months in a row without any NSFs or late payments, you can greatly improve your credit rating.

If you are able to maintain a perfect (or near perfect) payment history, the chances of getting approved for a lower interest rate down the road will be significantly higher.

What if I need a third or fourth chance?

Okay, so things have been bad, and maybe you’ve experienced a bankruptcy, or gone through a messy divorce, or maybe both? Your credit score is at an all time low from repeat offences on your credit bureau. The good news is, we can still help. Our dealer partners are committed to getting you on the road, as long as you are committed to helping yourself. We understand that everyone’s situation is unique, but there becomes a point when

Where can I apply?

It’s super easy. The fastest way to apply is online by filling out our online application form. Alternatively, you can call one of our customer specialists at 1-855-214-3552.

After we have received your application, we will get to work immediately and help find you the vehicle that you want. Remember, our services are free and come with no obligations.

14